In the significant and tricky global financial markets, successful trading isn’t merely a count of luck. It includes deep information on market dynamics, disciplined strategies, and the potential to navigate through the complexities of buying and promoting belongings.

This article aims to unveil the golden rules of profitable trading and selling – a set of ideas that stand the check of time and manual traders towards consistent achievement.

The Foundation: Knowledge is Power

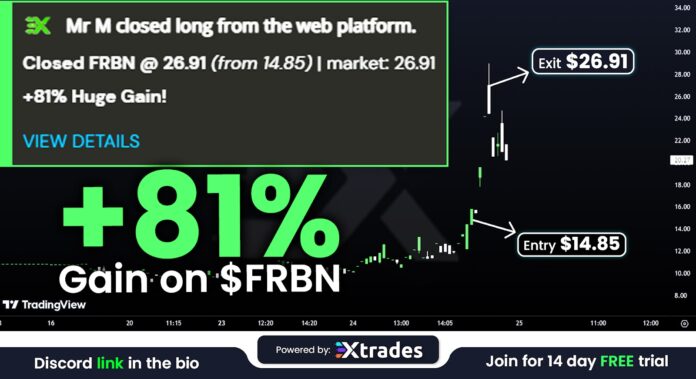

At Xtrades, we understand the importance of having a well-defined set of rules to guide you through the complexities of this trading style.

Whether you are a seasoned trader looking to refine your skills or a newcomer eager to explore the world of swing trading rules, our website is designed to be your go-to destination for insightful guidance and practical strategies.

Understanding Market Basics

The first golden rule of profitable trading is rooted in know-how. Before diving into the markets, investors need to have a strong knowledge of marketplace basics. This includes knowledge of different asset instructions, market tendencies, economic signs, and the factors influencing rate actions.

Continuous Learning

Markets evolve, and successful investors by no means prevent studying. Staying knowledgeable approximately marketplace information, financial reviews, and worldwide events is crucial.

Continuous gaining knowledge of now not simplest complements your trading competencies but additionally enables you to adapt to changing marketplace situations.

Risk Management: Preserving Capital

Risk-Reward Ratio

One of the most important golden guidelines is powerful risk management. Traders should decide on a clear risk-reward ratio earlier than getting into any trade.

This ratio facilitates placing realistic earnings targets and prevent-loss ranges, ensuring that potential losses are controlled even while bearing in mind worthwhile possibilities to flourish.

Diversification

Diversifying your funding portfolio is a fundamental component of risk management. The golden rule here is not to position all your eggs in a single basket.

A nicely-various portfolio spreads hazard across specific properties, lowering the impact of a bad-appearing investment on the overall capital.

The Discipline of Patience

Avoiding Impulsive Decisions

Impulsivity is the enemy of profitability in trading. The golden rule of staying power emphasizes the significance of keeping off impulsive decisions.

Waiting for the right entry points, confirming signals, and adhering to your buying and selling plan are crucial additives for affected persons and disciplined trading.

Long-Term Vision

Profitable trading isn’t always about quick wins; it’s about lengthy-time period achievement. Traders who adhere to the golden rule of endurance understand that no longer every alternate might be a winner. By retaining a protracted-term imaginative and prescient and fending off knee-jerk reactions to short-term marketplace fluctuations, buyers boom their chances of sustainable profitability.

Technical Analysis: Charting the Course

Understanding Technical Indicators

Successful investors frequently incorporate technical evaluation into their strategies. This golden rule involves know-how and effectively utilizing technical indicators along with shifting averages, relative electricity index (RSI), and trendlines.

These gear assist buyers in picking out potential entry and go-out points, in addition to developments in the marketplace.

Chart Patterns

Recognizing chart patterns is another vital element of technical evaluation. Traders who can discover patterns like head and shoulders, double tops or bottoms, and triangles benefit from insights into capability future fee moves. This golden rule provides a layer of precision to trading choices.

Emotional Intelligence: Mastering the Mind

Controlling Emotions

Emotions can cloud judgment and lead to irrational decisions. Successful buyers follow the golden rule of emotional intelligence by retaining their emotions in take a look at.

Whether faced with a prevailing streak or a losing streak, preserving a relaxed and rational attitude is paramount to profitable buying and selling.

Learning from Losses

Losses are an inevitable part of buying and selling. Emotionally smart buyers do not permit losses to demoralize them; alternatively, they view them as opportunities to learn and enhance.

This golden rule ensures that every setback becomes a stepping stone closer to extra talent in the markets.

Adaptability: Riding the Waves

Market Adaptation

Markets are dynamic, and the capacity to adapt is a golden rule for worthwhile buying and selling. Traders must be aware of converting marketplace conditions, economic shifts, and worldwide occasions.

Being rigid in approach may also lead to overlooked opportunities or needless risks, emphasizing the need for a flexible technique.

Continuous Strategy Evaluation

Adaptability additionally entails frequently evaluating and refining buying and selling strategies. What labored the day before this might not work the day after today.

By staying vigilant and adjusting strategies based totally on performance and marketplace shifts, investors can make sure that their technique remains effective in unique market environments.

Also Read : The Complete Guide to Choosing the Right Law Office for Your Needs

Conclusion

In the pursuit of profitable buying and selling, those golden regulations serve as a guiding light. Knowledge, threat control, discipline, technical analysis, emotional intelligence, and flexibility together form the pillars of successful buying and selling.

By embracing these standards, investors can navigate the complexities of economic markets with self-belief, growing their chance of accomplishing sustained profitability.

Remember, in the world of trading, it’s no longer approximately heading off risks altogether but dealing with them correctly to emerge positive within the ever-evolving panorama of financial markets.